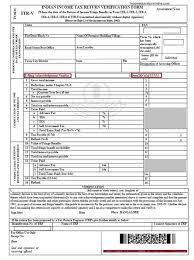

An ITR certificate is a document issued by the Income Tax Department of India to taxpayers who have filed their income tax returns. The certificate contains details of the taxpayer’s income, deductions, and taxes paid. It is used as proof of income for a variety of purposes, such as applying for a loan, a credit card, or a visa.

To get an ITR certificate, you must first file your income tax return. You can do this online or by mail. Once your return has been processed, you will be able to download your ITR certificate from the Income Tax Department website.

The ITR certificate is a valuable document that can be used to prove your income. It is important to keep it safe and to make sure that you have a copy of it in case you need it.

Here are some of the benefits of having an ITR certificate:

- It can be used as proof of income for a variety of purposes, such as applying for a loan, a credit card, or a visa.

- It can be used to claim tax refunds.

- It can be used to dispute tax assessments.

- It can be used to prove your income to the government.

If you have any questions about ITR certificates, you can contact the Income Tax Department.